A liquid biopsy is an emerging approach for disease treatment and prevention that considers individual variability in genes, environment, and lifestyle for each person. The ultimate goal of liquid biopsy is to provide the right treatment, to the right patient, at the right time. Liquid biopsy is one of the most modernized trends in the healthcare industry, which has shown tremendous progress in 2019-2021. The use of non-invasive liquid biopsy for analyzing fetal cell-free DNA (cfDNA) can offer critical information, which could tell the physician and the mother whether to continue a pregnancy or not. In addition, research is also being conducted to assess the clinical potential of extracellular vesicles (EVs) to screen metabolic disorders, including diabetes. It is worth mentioning here that EVs contain nucleic acids, particularly microRNA (miRNA), which is an excellent source to monitor the progression of metabolic disorders.

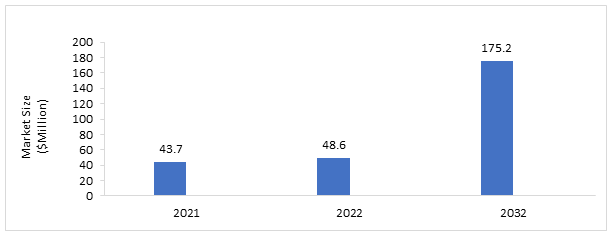

In 2021, the Middle East liquid biopsy market was valued at $43.7 million, and it is expected to reach $175.2 million by 2032, growing at a CAGR of 13.68% during the forecast period 2022-2032. The Middle East liquid biopsy market is expected to witness high growth due to the rising incidence of cancer, the increasing fund infusions for conducting research to discover novel biomarkers, and the growing emphasis on the use of non-invasive methodologies for performing a liquid biopsy. The constant significant investments by healthcare companies to meet industry demand and the increasing adoption of liquid biopsy among major end users are significant factors propelling the growth of the Middle East liquid biopsy market.

Impact of COVID-19

The current Middle East liquid biopsy market study comprises products and services utilized to analyze underlying alterations in circulating biomarkers from non-invasive sample types. Since the market is primarily dominated by the clinical utility of products and services, the COVID-19 pandemic had a high impact on the growth and revenue generated from the market. The current market assessment has considered information provided by key opinion leaders in the market from both supply and demand sides. Although manufacturers have witnessed low-scale losses due to decreased demand, the losses incurred for the first two quarters of FY2020-2021 are anticipated to be compensated by higher demands in the following two quarters in FY2021.

However, the industry is still expected to be impacted significantly during the period 2020-2022. The low influx of cancer patients in hospitals and diagnostic laboratories has massively impacted the sales of Exact Sciences' Cologuard test. In 2020, Exact Sciences Corporation was the market leader in the non-invasive liquid biopsy ecosystem, having a 74.31% share in the Middle East liquid biopsy market.

Market Segmentation

Segmentation 1: by Technology

• Polymerase Chain Reaction (PCR)

• Next-Generation Sequencing (NGS)

• Fluorescence In-Situ Hybridization (FISH)

• Other Technologies

The Middle East liquid biopsy market (by technology) was dominated by the next-generation sequencing (NGS) segment in 2021. This was due to an increasing number of NGS kits that providers offer to their end users.

Segmentation 2: by Workflow

• Sample Preparation

• Library Preparation

• Sequencing

• Data Analysis

In 2021, the library preparation segment dominated the Middle East liquid biopsy market (by workflow) due to an increasing number of patients suffering from cancer. According to the data published by the World Health Organization, cancer is a leading cause of death, with nearly 10 million deaths reported in 2020.

Segmentation 3: by Usage

• Research Use Only (RUO)

• Clinical

The Middle East liquid biopsy market (by usage) was dominated by the research use only segment in 2021. This growth was attributed to the academic research and industry collaboration in the Middle East region. Moreover, the technological advancement in RUO products is boosting the growth of the Middle East liquid biopsy market.

Segmentation 4: by Sample

• Blood

• Urine

• Saliva

• Cerebrospinal Fluid

In 2021, the Middle East liquid biopsy market (by sample) was dominated by the blood segment owing to an increasing number of patients suffering from different cancers.

Segmentation 5: by Circulating Biomarker

• Circulating Tumor Cells (CTCs)

• Cell-Free DNA (cfDNA)

• Circulating Cell-Free RNA

• Exosomes and Extracellular Vesicles

• Other Circulating Biomarkers

The Middle East liquid biopsy market (by circulating biomarker) in 2021 was dominated by the cell-free DNA segment due to an increasing number of research studies pertaining to liquid biopsy segment.

Segmentation 6: by Product

• Tests/Services

• Kits and Consumables

• Instruments

The tests/services segment dominated the Middle East liquid biopsy market (by product) in 2021 due to the continued significant investments by healthcare companies to meet industry demand for tests/services, and the growing adoption of liquid biopsy tests among major end users were the key factors propelling the growth of the segment.

Segmentation 7: by Country

• K.S.A.

• Israel

• Egypt

• U.A.E.

• Iran

• Qatar

• Rest-of-the-Middle East

The K.S.A. generated the highest revenue of $13.5 million in 2021, which is attributed to the RD advancements in the field of single-cell analysis and the presence of dominating players operating in the Middle East liquid biopsy market.

Recent Developments in Middle East Liquid Biopsy Market

• In October 2020, Bio-Rad Laboratories launched the CFX Opus 96 Dx System and CFX Opus 384 Dx System. The product could multiplex about five samples to offer effective in-vitro diagnostics (IVD) assay development and testing. The product has been commercialized in the Middle East region.

• In March 2021, F. Hoffmann-La Roche Ltd released the AVENIO Tumor Tissue CGP Kit, enabling laboratories to extend their oncology research in-house.

• In June 2019, F. Hoffmann-La Roche Ltd partnered with the Health Authority and an international health insurer, AXA, in Dubai. This partnership would develop funding for diagnostic and treatment for breast, colorectal, and cervical cancers.

Key Market Players and Competition Synopsis

The companies that are profiled have been selected based on inputs gathered from primary experts and analyzing company coverage, product portfolio, and market penetration.

Some prominent names established in this market are:

• Bio-Rad Laboratories, Inc.

• Bioscience Institute S.p.A.

• Eurofins Scientific

• F. Hoffmann-La Roche Ltd

• Guardant Health

• Illumina, Inc.

• Natera, Inc.

• NeoGenomics Laboratories, Inc.

• PerkinElmer Inc.

• QIAGEN N.V.

• Sysmex Corporation

• Thermo Fisher Scientific Inc.

Request Sample - https://bisresearch.com/requestsample?id=1302type=download

How Can This Report Add Value to An Organization?

Product/Innovation Strategy: The product segment helps the reader understand the types of products, i.e., tests/services, kits and consumables, and instruments. These ecosystems are the primary focus of the study as these are the target of market players in terms of revenue generation. Moreover, the study provides the reader with a detailed understanding of the different applications such as lung cancer, breast cancer, prostate cancer, colorectal cancer, melanoma, other cancers, and non-oncology disorders.

Growth/Marketing Strategy: The Middle East liquid biopsy market has been dominated significantly by companies such as QIAGEN N.V., PerkinElmer, Inc., F. Thermo Fisher Scientific Inc., and Hoffmann-La Roche Ltd., due to their expansive portfolio and strong geographical presence across the world. Many companies such as Agilent Technologies, Inc., Thermo Fisher Scientific Inc., PerkinElmer, Inc., Beckman Coulter, Inc. (Danaher Corporation), Illumina, Inc., and Bio-Rad Laboratories, Inc. lie in the low growth and low market share segment. Most key market players in the Middle East liquid biopsy market are categorized under the low growth and low market share segment. The low market share of these companies is primarily due to limited products with respect to the Middle East liquid biopsy market in comparison to other segments of these companies. Also, the lack of synergistic activities with respect to the market is responsible for the low growth of these companies.

Competitive Strategy: Key players in the Middle East liquid biopsy market analyzed and profiled in the study have involved the oncology application-based product manufacturers that provide liquid biopsy tests and services. Moreover, a detailed competitive benchmarking of the players operating in the Middle East liquid biopsy market has been done to help the reader understand how players stack against each other, presenting a clear market landscape. Additionally, comprehensive competitive strategies such as partnerships, agreements, and collaborations will aid the reader in understanding the untapped revenue pockets in the market.

The study defines the liquid biopsy products and services that use truly non-invasive sample types, including stool, urine, saliva, and other sample types, which offer better patient compliance. The liquid biopsy products and services are used for the identification and analysis of circulating biomarkers, including circulating tumor DNA (ctDNA), circulating tumor cells (CTCs), circulating microRNA (miRNA), DNA methylation-based biomarkers, exosomes, and extracellular vesicles (EVs), from non-invasive sample types

BIS Related Studies

Liquid Biopsy Market - A Global and Regional Analysis