"Bad debt" is the amount that an organization is unable to collect from a debtor because he or she has declared bankruptcy or is otherwise unable to pay. Although QuickBooks provides the opportunity to reconcile accounts, debt may significantly affect a company's income. Bad debts or unrecoverable accounts are frequently connected to accounts receivable. This article shall brief users with comprehensive procedures to write off bad debt in QuickBooks Desktop.

Need to write off Bad Debt

Financial businesses are obligated to keep track of bad debts since they frequently sell on credit. Debts that are unpayable must be written off. You may acquire the precise net profit number by removing invoices from account receivables in the QuickBooks Desktop application by writing off bad debts.

Procedure to Write Off Bad Debt in QuickBooks Desktop

Step 1: Add Expense Account

- Choose Chart of Accounts from the Lists menu.

- After that, select New from the Account menu.

- Tap on Continue after selecting Expense.

- After that, type the account name, such as "Bad Debt."

- To complete, click the Save button.

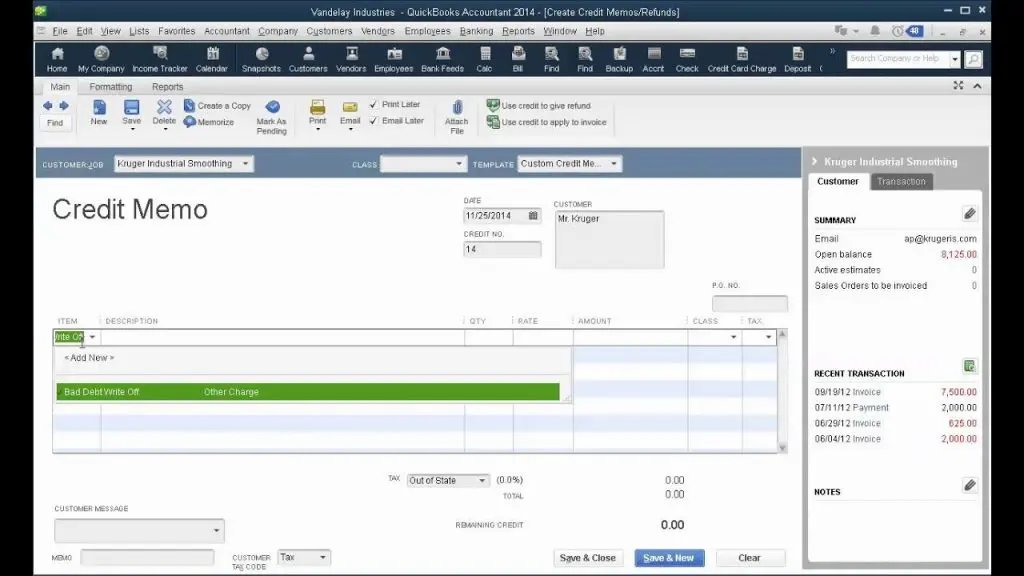

Step 2: Check Unpaid Invoices

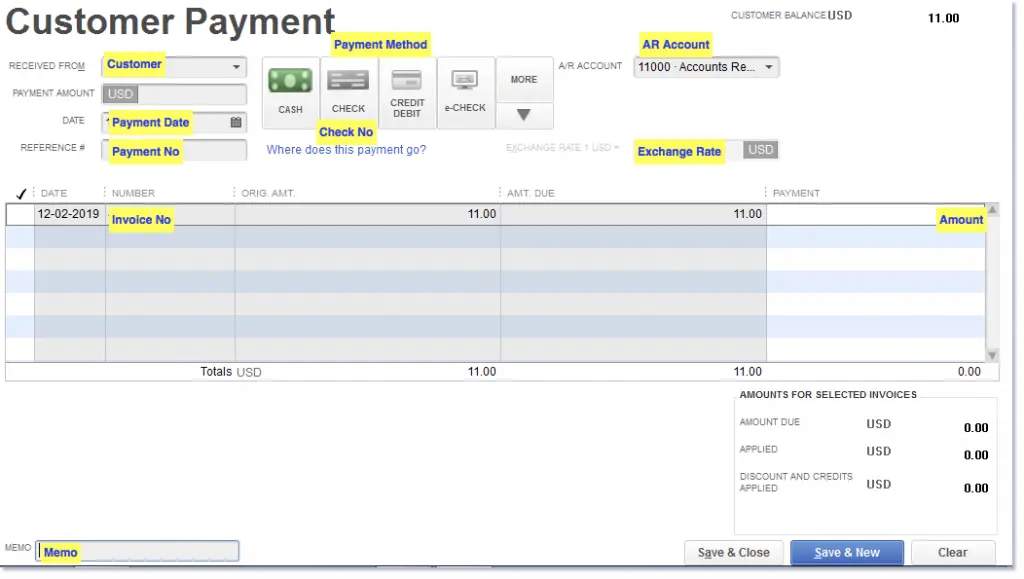

- To start, choose Accept Payments from the Customers menu.

- Type the client's name in the Received field after that.

- Enter "$0.00" for the payment amount.

- Choose Discounts and Credits from the menu.

- Enter the desired amount in the "Amount of Discount" box.

- After that, select the account you added for the Discount Account in the previous step and click Done.

- Click on the Save button.

Final Words! Facing difficulties? Call us on our helpline

Users should now be able to write off bad debt in QuickBooks Desktop. If any technical issue bothers you, just give our error support experts a call at the helpline at +1-800-761-1787 to let our experts resolve the error on your behalf.