The global axial spondyloarthritis market is well entrenched. Biopharmaceutical companies are trying to match themselves with new technologies in the market to improve the overall system from drug discovery to drug commercialization. The companies operating in the global axial spondyloarthritis market are now focusing more on biologics and personalized therapy to enhance therapeutics and improve patient outcomes. Also, major players such as AbbVie Inc., Eli Lilly and Company, Novartis International AG, and Pfizer Inc. are investing heavily in clinical trials for their respective therapeutic candidates to treat axial spondyloarthritis. Increasing investments in the research and development of drug manufacturing is one of the major opportunities in the global axial spondyloarthritis market.

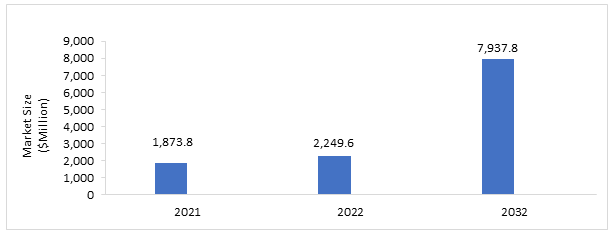

The global axial spondyloarthritis market was estimated to be at $1,873.8 million in 2021, which is expected to grow with a CAGR of 13.44% and reach $7,937.8 million by 2032. The growth in the global axial spondyloarthritis market is expected to be driven by the introduction of novel products, the increasing awareness about the disease, and the rising research and development investments, among others.

With an increased worldwide focus on treating axial spondyloarthritis, the major market players are developing novel therapeutics, such as anti-janus kinase therapy, anti-interleukin therapy, and anti-tumor necrosis factor therapy, which is significantly impacting the growth of axial spondyloarthritis market. Due to the introduction of tumor necrosis factor inhibitors and interleukin 17 inhibitors, a new era of drug therapy was initiated for previously largely incurable diseases. For instance, the U.S. Food and Drug Administration approved three novel products, i.e., Xeljanz, Taltz, and Cosentyx, in 2020 and 2021 to treat patients with axial spondyloarthritis.

Impact of COVID-19

The COVID-19 pandemic has exerted tremendous strain on the research and clinical development of axial spondyloarthritis emerging therapies. Companies operating in axial spondyloarthritis have changed their focus on the research and development of drugs used for COVID-19 treatment to help governments and communities establish a new normal across the globe. This has resulted in the delayed launch of emerging therapies due to a shift in priorities regarding the COVID-19 pandemic.

In addition, the clinical trials have slowed down since the COVID-19 outbreak. The primary reason has been the difficulty in patient recruitment for the ongoing clinical trials, which will impact the launch timelines of the drugs. Most healthcare conferences were canceled, and most marketing activities transitioned to virtual methods. Moreover, organizations, such as CDC and ASCO, have indicated to refrain from clinical visits to patients.

Market Segmentation

Segmentation 1: by Commercialized Therapies

• Anti-Tumor Necrosis Factor (TNF) Therapy

• Anti-Interleukin (IL) Therapy

• Anti-Janus Kinase (JAK) Therapy

In 2021, the global axial spondyloarthritis market in the commercialized therapies segment was dominated by the anti-tumor necrosis factor therapy segment. Years of successive and significant innovations in anti-tumor necrosis factor therapies have demonstrated tremendous potential in treating distinct indications of axial spondyloarthritis.

Segmentation 2: by Potential Pipeline Products

• Anti-Janus Kinase (JAK) Therapy

• Anti-Interleukin (IL)-17 Therapy

• Other Therapy

In 2032, the global axial spondyloarthritis market is estimated to be dominated by the anti-interleukin 17 therapy and is expected to hold a 39.49% share of total potential pipeline products. Other therapy includes anti-Granulocyte/macrophage colony stimulating factor (GM-CSF) therapy and anti-phosphodiesterase 4 (PDE4) therapy.

Segmentation 3: by Indication

• Ankylosing Spondylitis

• Non-Radiographic Axial Spondyloarthritis

The ankylosing spondyloarthritis segment dominated the global axial spondyloarthritis market in 2021 due to a greater number of product approvals in seven major countries compared to non-radiographic axial spondyloarthritis.

Segmentation 4: by Country

• U.S.

• Germany

• France

• U.K.

• Italy

• Spain

• Japan

The U.S. axial spondyloarthritis market was valued at $1,231.2 million in 2021 and is the leading market contributor. The growth can be attributed to the increased research and development activities in the country.

Recent Developments in the Global Axial Spondyloarthritis Market

• In December 2020, AbbVie's Upadacitinib (RINVOQ) met primary as well as secondary endpoints in the Phase III study for non-radiographic axial spondyloarthritis.

• In August 2020, AbbVie, Inc. submitted an application to the U.S. Food and Drug Administration (FDA) to seek approval for RINVOQ (Upadacitinib) to treat adult patients with active ankylosing spondylitis.

• In March 2020, Novartis International AG received a positive CHMP opinion which recommended a positive opinion for Cosentyx for the treatment of active non-radiographic axial spondyloarthritis (nr-axSpA).

• In June 20219, Kyowa Hakko Kirin Co., Ltd. stated a positive result of a 16-week efficacy and safety analysis of the Phase 3 study of Brodalumab in patients with ankylosing spondylitis and non-radiographic axial spondyloarthritis.

Demand – Drivers and Limitations

Following are the demand drivers for the global axial spondyloarthritis market:

• The Introduction of Novel Products

• Increasing Awareness About the Disease

• Rising Research and Development Investments

The market is expected to face some limitations too due to the following challenges:

• High Treatment Cost Impacting the Adoption Rate

• Increased Delay in Diagnosis

Analyst Thoughts

According to Vaishali Chauhan, Research Analyst, BIS Research, " The global axial spondyloarthritis market is a small segment of the entire arthritis market and is growing. Moreover, along with it, the growing interest of the pharmaceutical industry in the therapeutic potential for treating axial spondyloarthritis has been a catalyst for the progress in the global axial spondyloarthritis market. Although most commercialized products for the treatment of axial spondyloarthritis include anti-tumor necrosis factor therapy and anti-interleukin 17 therapy, anti-janus kinase therapy is also anticipated to increase given the ability to fulfill unmet medical needs and address the complex, challenging targets.

Key Market Players and Competition Synopsis

The companies that are profiled have been selected based on inputs gathered from primary experts and analyzing company coverage, product portfolio, and market penetration.

Total Number of Companies Profiled: 12

Public companies include AbbVie Inc., Amgen Inc., Bristol-Myers Squibb Company, Eli Lilly and Company, Johnson Johnson Services, Inc., Kyowa Kirin Co., Ltd., Merck Co., Inc., Novartis International AG, Pfizer Inc., Takeda Pharmaceutical Company Limited, and UCB S.A. The private company profiled is FunPep Co., Ltd.

Request Sample Report - https://bisresearch.com/requestsample?id=1299type=download

How Can This Report Add Value to an Organization?

Product/Innovation Strategy: The product segment helps the reader understand the commercialized therapies present in the market, along with potential pipeline products that are in different stages of clinical trials. Moreover, the study provides the reader with a detailed understanding of two different indications such as ankylosing spondyloarthritis and non-radiographic axial spondyloarthritis.

Growth/Marketing Strategy: The global axial spondyloarthritis market has seen major development by key players operating in the market, such as regulatory and legal activities, product approvals, partnerships and alliances, and merger and acquisition activities. The favored strategy for the companies has been regulatory and legal activities along with product approvals to strengthen their position in the market. For instance, in December 2021, Pfizer Inc. received approval for Xeljanz/Xeljanz XR (tofacitinib) by the U.S. Food and Drug Administration to treat adults dealing with active ankylosing spondylitis (AS).

Competitive Strategy: Key players in the global axial spondyloarthritis market analyzed and profiled in the study involve axial spondyloarthritis-based drug manufacturers. Moreover, a detailed competitive benchmarking of players operating in the global axial spondyloarthritis market has been done to help the reader understand how players stack against each other, presenting a clear market landscape. Additionally, comprehensive competitive strategies such as partnerships, agreements, and collaborations will aid the reader in understanding the untapped revenue pockets in the market.

BIS Related Studies